AfCFTA🌍 African Continental Free Trade Area:

TRI Executive Leadership Development Program for Success Entrepreneurial thinking, innovation, and new technologies are powering startups and creating business opportunities for savvy entrepreneurs, intrapreneurs, and investors.

Economic integration in Africa is a strategy to increase the continent’s economic integration by creating a single market for goods and services. The African Continental Free Trade Area (AfCFTA) is a strategic framework that started trading in January 2021. African countries are working together to address common challenges and harness their shared strengths to realize the continent’s potential market of 1.2 billion people. The African Continental Free Trade Area (AfCFTA) is a strategic framework that creates a single market of goods and services for deeper economic integration on the African continent. To make this ambitious project a success, coordination will be needed at the local, national, regional and continental levels.

Supporting African multilateralism: Gradual implementation of the AfCFTA

🌍 Bringing Africa to the forefront of the International scene with consideration on the authentic development of the African communities in Africa and around the world. Bringing together 54 signatory states among the continent’s 55, the AfCFTA aims to create the world’s largest free trade zone, representing a market of 1.3 billion consumers. More in the following article:

AFRICAN CONTINENTAL FREE TRADE AREA

US-Africa Bilateral Agreements – Bilateral investment treaties (BIT)

A bilateral investment treaty (BIT) is an agreement concluded between two States which defines the broad terms and conditions under which private and companies invest in each others territories. The United States has concluded a number of BITs with various countries, including African countries. The stated basic aims of this BIT program includes the following key objectives:

- to protect investment abroad especially in countries where investor rights are not already protected through existing agreements

- to encourage the adoption of market-oriented domestic policies which treat private investments in an open, transparent and non-discriminatory way

- to support the development of international law standars that are consisten with these objectives

The United States has concluded BITs with various African countries, inter alia with Rwanda, Mozambique, Republic of Congo, Congo DRC and Cameroon.

Trade and Investment Framework Agreements (TIFA)

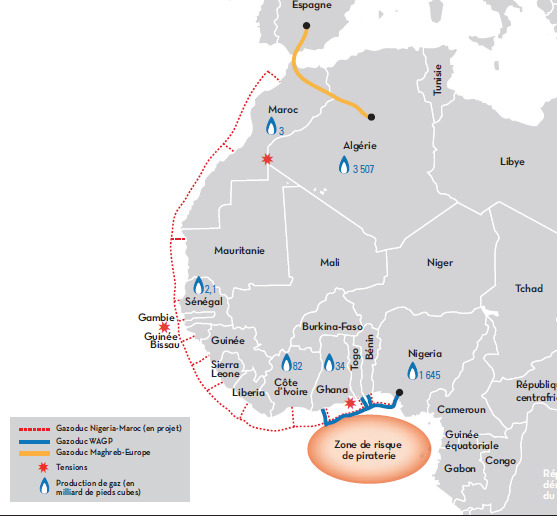

Trade and Investment Framework Agreements (TIFA) provide strategic frameworks and principles for dialogue on trade and investment issues between the United States and the other parties to the TIFA. These agreements generally go beyond the BIT model. TIFAs have been concluded with a number of African partner countries, inter alia with Angola, Ghana, Liberia, Mauritius, Mozambique, Nigeria, Rwanda and South Africa, as well as various regional country groups, such as COMESA, EAC and WAEMU. Discussions and negotiations with the SACU group are ongoing.

When the Past Divisions are the Path to the Present Vision of Unity in Africa

The African Continental Free Trade Area (AfCFTA) is a preferential trade regime aiming to progressively dismantling tariffs on goods and services produced on the continent, or with raw materials from Africa. The intention behind this large-scale project is to promote the free circulation of goods and thus stimulate intra-continental trade.

African leaders on Wednesday, March 23, 2018, signed three major economic agreements during the extraordinary session of Heads of State and Government of the African Union (AU) in Kigali, creating a Continental Free Trade Area (Zlec), perceived as essential to Africa’s economic development, through increased intra-African trade.

Some 44 countries signed the agreement establishing the African Continental Free Trade Area, while 43 heads of state signed the Kigali declaration for the launch of Zlec, and 27 signed protocols relating to the free movement of people, right to residence, and right of establishment.

Zlec gave birth to the largest free trade area in the world since the World Trade Organization which was established in 1995. Nineteen presidents attended as a number of prime ministers and government officials also signed for their respective countries.

Heavyweights, such as Morocco, Egypt, Kenya, and yet very protectionist Algeria, have signed the agreement, which will enter into force within 180 days after being ratified by the signatory countries.

“Some countries have reservations and have not yet finalized their national consultations. But we will have another summit in Mauritania in July and we hope these countries will sign then,” said AU Commissioner for Trade and Industry, Albert Muchanga.

Eleven countries out of the fifty-four countries of the AU are still missing, including Nigeria, whose President Muhammadu Buhari had decided not to make the trip to Kigali, after one of the largest unions in the country, Nigeria Labor Congress (NLC), had expressed its fears on the negative effects of the Zlec for the national economy. This union had also asked to be more involved in the negotiations and Mr. Buhari had agreed to “give more time to consultations”. Nigeria was one of the first economies on the continent, which had nevertheless coordinated the negotiations with Egypt. Other countries that have not signed the agreement include South Africa, and Benin, countries seeking taxes, especially on products transiting through their ports or roads, including Eritrea, Burundi,

Zlec must allow the gradual elimination of customs duties between member countries, thus promoting trade within the continent and allowing African countries to emancipate themselves from an economic system that is too focused on the exploitation of raw materials. The AU estimates that the implementation of Zlec will increase the level of intra-African trade by nearly 60% by 2022. Currently, only 16% of African countries’ trade is with other countries on the continent.

If the 55 member countries of the AU sign the document, the Zlec will open access to a market of 1.2 billion people, for a cumulative GDP of more than 2,500 billion dollars. Its advocates believe it will help diversify African economies and industrialize the continent while providing a unique platform to negotiate better trade deals with the outside world. Zlec is one of the key projects highlighted by the AU in its Agenda 2063, a long-term development program that aims to facilitate the flow of goods and people on the continent. At its last summit, in January in Addis Ababa, the AU had thus announced the creation of a single and liberalized market for air transport, including 23 countries of the continent.

Under the theme: “Creating an African Market”, the initiative falls under the AU Agenda 2063 It is estimated that if all 55 AU Member States ratify it, the agreement will bring together 1.2 billion people with a combined gross domestic product (GDP) of over US$2 billion.

Cameroon is one of the countries committed to drive the development of a liberalized African market. On July 2, 2023, the Port Autonome de Kribi, Cameroon’s second largest port, welcomed its first cargo under the AfCFTA regime, from Tunisia. Cameroon had already launched a first wave of goods exports under this regime at the end of 2022.

The process of dismantling customs tariffs has begun in the country, in line with the outline adopted by the AfCFTA authorities: to ensure a smooth transition to market liberalization, customs tariffs will be gradually reduced to zero over 13 years. The first 10 years will concern 90% of the products identified by the authorities, and 7% of products over the remaining years. Certain “sensitive” products (3%) will be excluded from liberalization, in order to protect local industries from increased competition.

JOIN OUR GROUP AT LINKEDIN: AFRICAN-MOROCCAN DIASPORA WORLD-CLASS EXECUTIVES

.png)