Updated on 7/29/2024 – 3:43 PM

Nigeria is blessed with abundant natural resources, especially crude oil. It is at times the largest oil producer in Africa and one of the top ten in the world. However, the country’s refining capacity has consistently been inadequate to meet the demands of its population and growing economy.

Nigeria’s refining infrastructure is plagued by inefficiency, underinvestment, and corruption. The country has four state-owned refineries that have become dysfunctional due to poor maintenance, outdated technology, and operational inefficiencies.

This deficit requires importing many of its fuel needs, leading to a complex and often controversial reliance on foreign fuel sources.

The government often subsidizes fuel to make it affordable, creating a huge financial burden on the state. While these subsidies are intended to alleviate economic hardship, they have also led to corruption and mismanagement.

Efforts have been made to address these challenges. The government has worked on various reforms, including partially removing the subsidy to improve the efficiency of the oil and gas sector, attract private investment, and increase local refining capacity.

The most notable development is the $20 billion Dangote Refinery, owned by Africa’s richest man, Aliko Dangote, with a refining capacity of 650,000 barrels per day. However, as the refinery is not yet operating at full capacity, Nigeria still imports fuel.

Beyond the fight, if things go as planned, Nigeria will stop importing fuel by August, as Dangote said. In 2023, Nigeria’s largest gasoline imports came from Togo, totaling $109.3 million, followed by Tunisia with $104.35 million, according to data from Trade Map, a global database on international trade statistics.

“THE FIELD OF PETROL DREAM IN NIGERIA” – BUILD IT, THEY WILL COME AS TROUBLE-MAKERS

Dangote recently revealed that some employees of the Nigerian National Petroleum Company (NNPC) Limited and oil traders, which own a blending plant off Malta, and international oil companies refusing to supply crude to its refineries, are among its challenges.

Alhaj Aliko Dangote GCON, the Founder /Chairman of Dangote Industries Limited speaks on the challenges of building his refinery in Lagos with the CNN anchor and correspondent, Eleni Giokos.

Audience with #H_E_Brice_Clotaire_OLIGUI_NGUEMA and our #PCE_Alhaji_Aliko_DANGOTE, Chairman of Dangote Industries Limited with the presence of Bertrand MBOUCK!

Pictures published by Bertrand MBOUCK •

Growing Support from Business Leaders for Alhaji_Aliko_DANGOTE

Several prominent Nigerians, including former Vice President Atiku Abubakar, former Anambra State governor, Peter Obi, and business mogul Femi Otedola, have voiced their support for Dangote. Otedola praised Dangote as a visionary who has made significant investments in Nigeria.

He highlighted Dangote’s achievements, including building the largest single-train refinery in the world, the second-largest sugar refinery, and the largest cement factory, among other substantial industrial projects.

“My brother, the Visionary, has built the largest single train refinery in the world, not in Kano, but in Lagos State. He is the owner of the second-largest sugar refinery in the world, also in Lagos State, and the largest cement factory in the world, not in Kano, but in Kogi State,” Otedola said.

“Additionally, he has established one of the second-largest fertilizer plants in the world, soon to surpass the biggest one in Qatar, also in Lagos State. Furthermore, he has built a fertilizer plant in Lagos that already exports globally. Aliko Dangote is a titan that God created especially for mankind,” he continued.

Among other things, Otedola noted Dangote’s role as the largest private sector employer in Nigeria and a significant taxpayer. He also noted that Dangote Group’s contributions extend beyond industrial facilities to critical infrastructure projects, such as major roads in Lagos and Kogi states.

“His contributions extend beyond industrial facilities to critical infrastructure, having built major roads such as the Apapa Oshodi-Owonrosoki Express Road, Wharf Road, and the Obajana-Kabba Road,” he recounted.

Otedola advised the federal government to emulate other countries by supporting local industries like the Dangote Group for the country to thrive.

Buying and selling oil by Nigeria and the related process and processing with the advising and confirming accounts along the transfer and the convertibility as well as the deposit notes with their approval of the office of the currencies change with also the variations in the rate of change between the foreign currencies involved including the consolidation terms and conditions. The process of buying and selling oil in Nigeria involves several intricate steps and financial mechanisms. Here’s a breakdown of the key elements:

Buying and Selling Oil in Nigeria

Transaction Procedures:

- The Nigerian National Petroleum Corporation (NNPC) oversees the sale of crude oil. Buyers typically engage directly with NNPC or its approved resellers 1.

- The process involves submitting bids for crude oil sale and purchase term contracts. Successful bidders are awarded contracts to lift and market Nigeria’s crude oil 2.

Advising and Confirming Accounts:

- Letters of Credit (L/C): These are commonly used in oil transactions to ensure payment. An issuing bank provides a letter of credit to the seller, guaranteeing payment upon presentation of specified documents 3.

- Advising Bank: The issuing bank sends the L/C to an advising bank in the seller’s country, which verifies its authenticity and forwards it to the seller 4.

- Confirming Bank: Sometimes, a confirming bank adds its guarantee to the L/C, ensuring payment even if the issuing bank defaults 3.

Currency Convertibility:

- Oil transactions are typically conducted in U.S. dollars due to the petrodollar system 5. This system simplifies international trade by using a widely accepted currency.

- Currency convertibility refers to how easily a country’s currency can be exchanged for another. High convertibility is crucial for smooth international transactions 6.

Deposit Notes and Approval:

- Deposit Notes: These are financial instruments used to secure payment. They are often issued by banks and must be approved by relevant financial authorities 7.

- Office of Currency Exchange: This office oversees the approval of deposit notes and ensures compliance with currency exchange regulations 7.

Foreign Currency Exchange Rates:

- Exchange rates can significantly impact the cost and profitability of oil transactions. Fluctuations in exchange rates between the U.S. dollar and other currencies involved in the transaction must be carefully managed 8.

- Hedging strategies are often employed to mitigate the risks associated with exchange rate volatility 8.

1: Nigerian Oil Services 2: Majorwaves Energy Report 3: Reed Smith 4: Federal Financial Institutions Examination Council 5: Investopedia 6: Investopedia 7: Charles Schwab 8: Energy Information Administration

President Bola Tinubu on Monday 7/29/2024 directed the Nigerian National Petroleum Company Limited (NNPC) to sell crude oil to the Dangote Refinery1 2. This decision came after Aliko Dangote, the owner of the refinery, expressed frustration over NNPC’s refusal to supply crude oil, which led him to consider selling his stakes in the refinery 3.

Key Points:

Presidential Directive:

President Tinubu ordered NNPC to sell crude oil to the Dangote Refinery in naira, aiming to stabilize the local currency and reduce the pressure on foreign exchange12.

The directive includes supplying 450,000 barrels of crude oil meant for domestic consumption to Nigerian refineries, using the Dangote Refinery as a pilot 4.

Dangote’s Concerns:

Aliko Dangote had threatened to sell his stakes in the refinery due to operational challenges and the refusal of NNPC to supply crude oil 3.

The refinery, which can process 650,000 barrels of crude oil per day, faced difficulties in securing adequate crude supplies 5.

Economic Implications:

The Federal Executive Council (FEC) approved offering 450,000 barrels, meant for domestic consumption, in naira to Nigerian refineries. Afreximbank will facilitate the trade, eliminating the need for international letters of credit and saving the country from making dollar payments. Bayo Onanuga, President Tinubu’s special adviser on information and strategy on Monday, 7/29/2024

The move to sell crude oil in naira is expected to reduce the need for international letters of credit and save the country billions of dollars used in importing refined fuel 4.

This decision is also seen as a way to support the local economy and ensure the smooth operation of the Dangote Refinery, which is crucial for Nigeria’s fuel supply 4.

According to wetin presidential aide Bayo Onanuga share wit tori pipo.

- President Tinubu bin propose and di FEC agree make NNPC dey sell crude to di Dangote refinery and oda upcoming refineries for naira.

- Di Dangote refinery currently need 15 shipments of crude oil annually, wey go reach total moni of $13.5 billion – NNPC promise to provide four of dis cargoes.

- FEC don approve say di 450,000 barrels wey dey meant for domestic consumption, make e dey offered in Naira to Nigerian refineries, using di Dangote refinery as pilot. Di exchange rate go dey fixed for di duration of dis transaction.

Na Afreximbank and oda settlement banks for Nigeria go arrange di trade between Dangote and NNPC Limited.

Oga Onanuga tok for statement say di “game changing intervention go stop di need for international letters of credit and also save di kontri of billions of dollars wey dem dey use import refined fuel.”

The president of Nigeria ordered the NNPC – Nigerian National Petroleum Corporation to sell oil to the Dangote Refinery, following the complain of the Owner Aliko Dangote about the refusal of the NNPC to sell to him crude oil and his decision to sell his stakes in the refinery and leave the oil refinery he has just built.

The directive from President Tinubu aims to address the operational challenges faced by the Dangote Refinery and support the local economy by stabilizing the naira and reducing foreign exchange pressures. This move highlights the importance of the Dangote Refinery in Nigeria’s energy sector and the need for cooperation between the government and private enterprises.

If you have more questions or need further details, feel free to ask! 😊

1: Legit.ng 2: MSN 4: Businessday NG 3: KahawaTungu 5: Business Insider Africa

Providing Basic Needs

We are a diversified and fully integrated conglomerate. The Group’s interests span a range of sectors in Nigeria and across Africa.

The core business focus of the Group, which started operations in 1978, is to provide local, value-added products and services that meet the ‘basic needs’ of the populace. … Read More

Aliko Dangote, GCON

Group President & Chief Executive

Aliko Dangote is the founder and president/chief executive of the Dangote Group, the largest conglomerate in West Africa. The Group currently has a presence in 17 African countries and is a market leader in cement on the continent. One of the Group’s subsidiaries, Dangote Cement Plc, is the largest listed company in West Africa and the first Nigerian company to join the Forbes Global 2000 Companies list. … READ MORE

Dangote African Carnegie and Rockefeller in Modern Time and Present Dimensions

America’s emergence as an industrial power in the late 19th century relied largely on two substances: oil and iron. And two people played an important role in providing this material.

Andrew Carnegie was born in Scotland in 1835 and his family moved to Pennsylvania when young Andrew was thirteen. John D. Rockefeller was born four years later in upstate New York, the son of a merchant who moved him to Cleveland when he was six.

Carnegie’s early work virtually traced the technological emergence of 19th-century America. He was a bobbin boy in a textile factory, a telegraph operator, and an engine supplier. He later worked on the railroads and oil wells. But at the age of 38, he established Keystone Iron Works, and he remained there until 1901. By that time, Keystone Iron had become American. Steel and Andrew Carnegie had become one of the richest men on the planet.

John D. Rockefeller went into business at the age of 20 and discovered his first oil well as a side hustle. He quickly understood that it was the right horse to ride. Even before automobiles and airplanes claimed a large share of oil, it had begun to replace coal in the electrical industries.

Carnegie and Rockefeller – both incredibly wealthy in the 20th century – came to give by two different paths: Even before reaching its peak, Carnegie wrote that a rich man’s life should take place in two stages: d First acquire wealth, then use that wealth to improve general well-being. And that’s what he did. He established the Carnegie Institute, the Tuskegee Institute, and many other schools. He became the patron saint of libraries. He created charitable foundations.

Rockefeller, on the other hand, began to relent when antitrust forces closed in on his Standard Oil Company. He also created charitable societies of all kinds to distribute excess money. He began by creating the University of Chicago. Whatever his motivations, Rockefeller gave birth to a dynasty of charitable giving that extends to the present day.

Andrew Carnegie is the best hero. After all, he was an integral part of the emerging technologies that shaped our country. And his gift flowed from a deeply held principle. Yet the Rockefeller clan took responsibility for public service. They became political leaders and professional donors: one of them died doing anthropological research in New Guinea.

Money creates responsibility. Sooner or later we realize that we can live in a decent world only when the money created by our technological foresight returns to increase the knowledge and beauty of this world.

TRI CONSULTING KYOTO TRI CK USA – Said El Mansour Cherkaoui Ph.D. – Said Cherkaoui Ph.D. Contact for needs of additional info:– Email: saidcherkaoui@triconsultingkyoto.com Haj Miloud Chaabi Rahimahou Allah Miloud Chaabi – 15 September 1930 – 16 April 2016 Aquermoud, near Essaouira, Morocco Died 16 April 2016 (aged 85), Hamburg, Germany Occupation Father, Businessman, People Man, Politician and Charitable … Continue reading

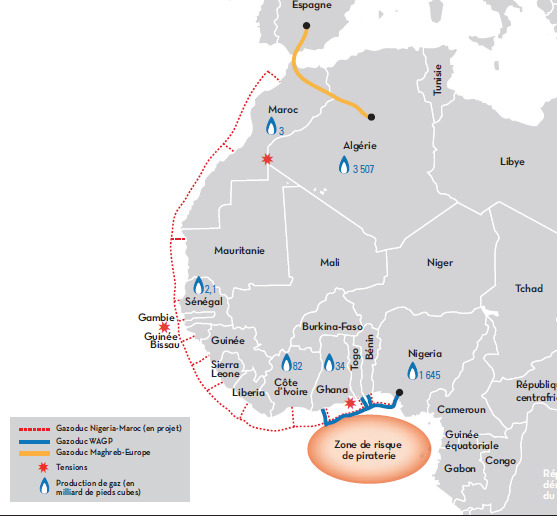

Europe and Nigerian Gas

– Said El Mansour Cherkaoui, Ph.D. Posted on – Currently, the war in Ukraine and the sanctions imposed by the United States and the European Commission have led to renewed interest in supplying European countries with alternative energy sources such as the Nigeria – Europe Gas Pipeline. This “opportunistic” revival is currently kept in turmoil by the continuing stalemate in the Russian-Ukrainian conflict following … Continue reading

Germany and Africa: New Clean Energetic Relation

“Germany and Africa: New Clean Energetic Relation” – Said El Mansour Cherkaoui, Ph.D. Posted on saidcherkaoui@triconsultingkyoto.com German Chancellor Olaf Scholz the New Teutonic African pledges €4 billion in #Africa’s green energy On November 20, 2023, Chancellor Scholz after meeting African leaders and heads of international organizations during the G20 conference, said the conference with African leaders was “the starting signal for stronger, reliable cooperation between Africa and Europe to realize … Continue reading