President Biden will visit Angola on October 13-15, 2024.

President Biden’s visit will fulfill the commitment made during the U.S. Africa Leaders Summit in December 2022. This is the first Presidential trip to Africa in over a decade demonstrating and celebrating the evolution of the U.S.-Angola relationship and the renewed importance of Angola in the investment of U.S. Capital in this part of Africa.

Read more: September 24, 2024

Statement from White House Press Secretary Karine Jean-Pierre on President Biden’s Travel to Germany and Angola

https://lnkd.in/gUfPqz3k

© Said El Mansour Cherkaoui – initially published on 9/11/2024

Angola Model and China Quest for Oil

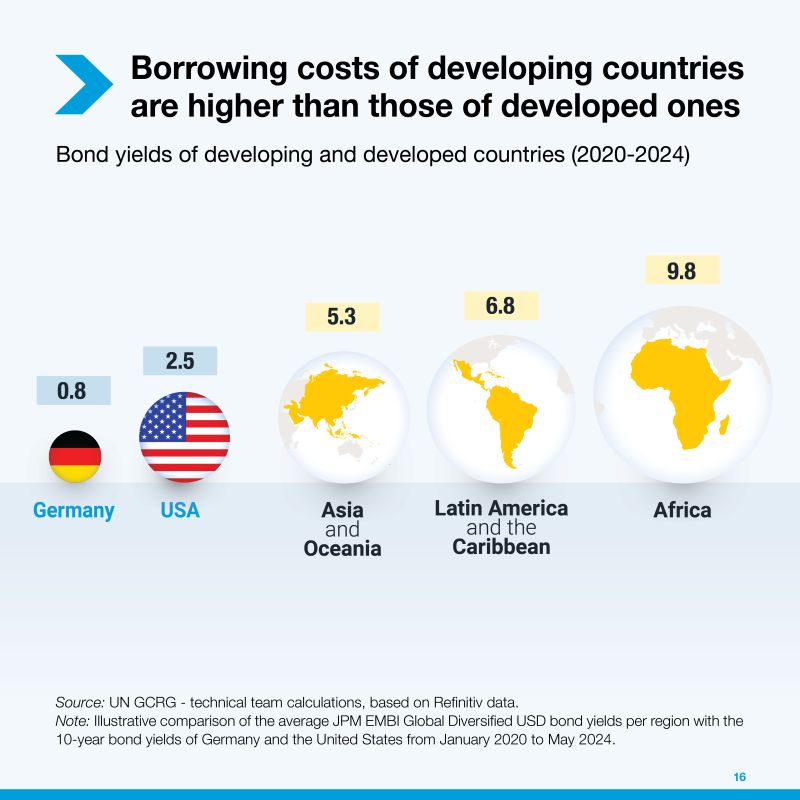

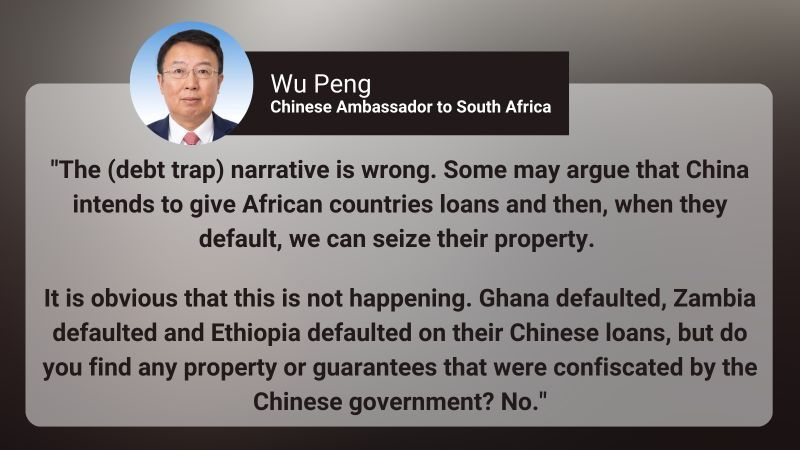

Concerns are growing in the US and other countries regarding economic cooperation between China and Africa including the so-called “debt trap,” according to the narrative dominating the western-based media outlets. These news agencies present China’s activities in Africa are driven by its will to increase its influence by extending excessive loans to developing countries that are used as traps to corner and influence the African economies.

Angola and Angola Model is frequently used as a case of such debt trap based on the extraction of natural resources or supply of energetic and strategic minerals by African nations in exchange for loans provided by China State and Financial Institutions.

Angola’s long-running financial relationship with China has been built on a simple equation: Angola would repay its growing Chinese debt with oil. This strategy became known as the Angola Model.

Since 2002, Angola has borrowed more than $45 billion from China, more than half of that going into its energy sector. More than a decade ago, Angola was China’s No. 2 source of crude oil. China receives nearly 72% of Angola’s oil exports, making it Angola’s largest oil importer.

According to a report from the Carnegie Endowment for International Peace: “In 2010, Angola was the world’s second-largest exporter of oil to China, after Saudi Arabia. But it has fallen down the list as Beijing has increasingly turned to the Arab states of the Gulf Cooperation Council, Russia, and other Asian countries.

In the early 2000s, Angola received US$42.6 billion from Chinese lenders, more than a quarter of China’s total lending to African countries between 2000 and 2020, which made it the largest recipient of Chinese loans in all of Africa. The School of Advanced International Studies-China Africa Research Initiative (SAIS-CARI), estimates that Angola was the top recipient of Chinese infrastructure loans, with US$ 43 billion worth of loan commitments, between 2000 and 2018.

However, the beginning of the end when between 2019 and 2023, Angola’s oil production fell 22% from 1.42 million barrels per day to 1.1 million barrels per day. The subsequent drop in business is straining Angola’s ability to keep up with its Chinese debt. As oil revenues have declined, by 2023, Angola had been bumped to number eight on this ranking of oil suppliers to China.” China receives nearly 72% of Angola’s oil exports, making it Angola’s largest oil importer. However, the recent drop in business is straining Angola’s ability to keep up with its Chinese debt. Since 2002, Angola has borrowed more than $45 billion from China, more than half of that going into its energy sector, according to Boston University.

Angola still owes Chinese lenders $17 billion. Chinese loans constitute about 40% of Angola’s total debt. Overall, debt payments consume about half of Angola’s national budget every year, placing it among African countries most vulnerable to a potential debt crisis, according to international credit rating agency S&P Global.

As oil revenues have declined, Angola has been forced to cover interest payments on its debt by tapping into a Chinese-held $1.5 billion escrow fund that was mandated as part of its loans. As China Buys Less Oil, as China has begun importing less oil from Angola and other African nations and more from Russia, the Persian Gulf, and Asia, Angola Struggles To Repay Debt.

Chinese lenders gave Angola a three-year reprieve on loan payments that ended in 2023 — just as Angola’s economy took a downturn. As oil revenues have declined, Angola has been forced to cover interest payments on its debt by tapping into a Chinese-held $1.5 billion escrow fund that was mandated as part of its loans. This year’s debt payment to Chinese leaders is estimated at $10.1 billion.

Angola recently left OPEC, the cartel of oil-producing countries, after a dispute over quotas. Angolan authorities hope that step will encourage more direct investment by China and other countries in its oil sector. In the meantime, the country’s leaders are trying to diversify their economy to reduce the impact of fluctuating oil prices.

This shift has been driven, in part, by African countries’ lack of investment in new oilfields and infrastructure. Aging equipment and shrinking oilfields make the continent’s oil producers, including Angola, less reliable as exporters, according to researchers with the Carnegie Endowment for International Peace.

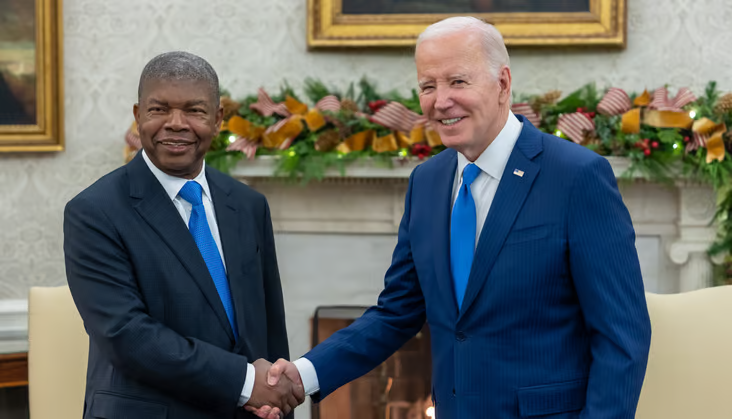

João Lourenço in the USA to participate in the 16th US-Africa business summit

As Angola President João Manuel Gonçalves Lourenço visits the White House on Thursday, November 30, 2024, the US is poised to strengthen a complex alliance developed during the past three decades of diplomatic ties between the two countries.

USAID Invests 3.5 Million Dollars in Environmental Issues in the Lobito Corridor

The United States Agency for International Development (USAID) in Angola announced, this Wednesday, the investment of 3.5 million dollars to support environmental issues of local organizations in the Lobito Corridor, in the province of Benguela

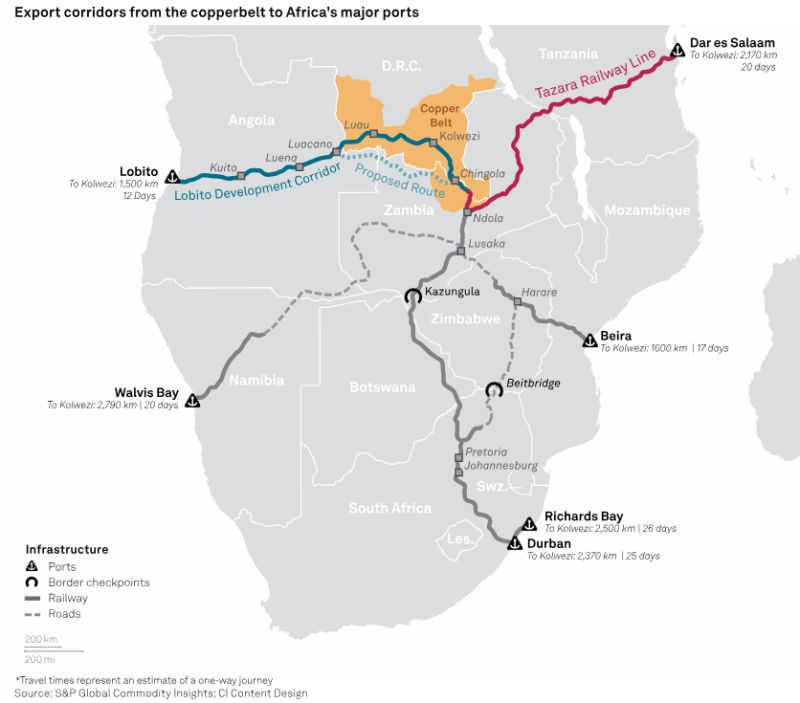

Lobito Port and Lobito Corridor:

Challenge of the Rivalry and Competition of the United States and China for Oil Resources of Angola and Mining Resources of Zambia

Zambia’s Bad Credit Bet for China, Good Mining Gamble for the West

2,683 impressions

saidcherkaoui@triconsultingkyoto.com

When the Missionaries arrived, the Africans had the Land and the Missionaries had the Bible. They taught us how to pray with our eyes closed. When we opened them, they had the land and we had the Bible. – Jomo Kenyatta

Reactions 2,683 impressions

https://lnkd.in/g2CFJqct

Contact author – saidcherkaoui@triconsultingkyoto.com

This publication has up to today 8/2/2024:

2,683 impressions and it keeps going up up up …

In the present article, we will emphasize the reasons for the setback experienced by the restructuring and rescheduling of Zambia’s External Debt and how even with the twist of events and alliances other projects such as the Liboto Corridor Project can become a double edge sword with 2 sharp sides and even to be transformed in the Sword of Damocles put on the top of the Zambia Head.

In the case of Lobito investment, China holds the primary role, and in Central Africa and Sahel, Russia with the military power making Africa more tuned toward a nationalistic approach for its development and using colonialism and neo-colonialism as the reason for changing the rulers by new military militants instead the legation of the western countries.

Lobito Investment:

The Lobito Atlantic Railway project, covering Angola, the Democratic Republic of Congo (DRC), and Zambia, is a significant infrastructure initiative. Led by the United States, the project aims to enhance logistical infrastructure in southern Africa. However, Chinese state-owned enterprises and private companies already dominate critical mineral supply chains (such as copper and cobalt) needed for electric vehicle components.

And there are countries with worrying amounts of Chinese debt. In Djibouti, China holds 77% of the national debt, while Zambia’s $6.4 billion in Chinese loans represents the lion’s share of its commitments. A spokesperson for China’s Ministry of Foreign Affairs (MOFA) told CNN via email that China has paid “high attention” to the African debt situation, and is dedicated to “sustainable development.”

United States – Angola: Rejevunating Courting Relationship

Press Release:

Corporate Council on Africa announces Angola as host of the 2025 U.S.-Africa Business Summit

Washington, D.C. – September 6, 2024 – The Corporate Council on Africa (CCA) has the high honor of announcing that the Government of the Republic of Angola will host the 17th U.S.-Africa Business Summit in 2025 in the city of Luanda, Angola.

Following a meeting of CCA leadership with His Excellency João Lourenço, President of the Republic of Angola during the May 2024 U.S.-Africa Business Summit in Dallas, Texas, a Memorandum of Understanding (MOA) was developed and was signed today in Washington, DC by H.E. Mr. Agostinho Van-Dunem, Ambassador of the Republic of Angola to the United States and Ms. Florizelle (Florie) Liser, President and CEO of CCA to officially mark this important collaboration.

The U.S.-Africa Business Summit is recognized as one of the most important business platforms that annually brings together African Heads of State and key Ministers, U.S. Cabinet officials and heads of major agencies, and CEOs and senior executives of U.S. and African companies to foster investment, trade, and commercial collaboration.

The 2025 Summit marks a significant milestone as Angola celebrates the 50th anniversary of its national independence and assumes the Chairmanship of the African Union (AU). Thus, co-organizing and hosting the U.S.-Africa Business Summit during such a momentous year underscores Angola’s firm commitment to promoting a new phase in as well as strengthening economic ties between Africa and the United States. Angola’s selection as the host country is a testament to its remarkable progress and potential as a key player in the African economy.

The Summit will showcase Angola’s diverse industries but will be continental in focus highlighting business and investment opportunities across the African continent in a range of sectors from energy and infrastructure to agriculture and technology, creative economy, manufacturing to digital economy and health.”We are delighted to bring the U.S.-Africa Business Summit to Angola in the Summer of 2025,” said Florie Liser, President and CEO of the Corporate Council on Africa. “This year’s Summit promises to be a landmark event, highlighting not only Angola’s economic potential and strategic importance as a leader in Africa, but recognizing the African continent’s increasing importance as a strategic economic, trade, and business partner of the U.S. Government and private sector.” The 2025 Summit will be a crucial opportunity to identify effective and sustainable solutions to diversify the African economy and to increase trade, investment, and business in sectors with a high impact on the lives of African and American people, enterprises, workers, and consumers. Participants will engage in high-level discussions on the critical issues and challenges, key sectors, and opportunities impacting the U.S.-Africa trade and investment relationship as well as sign deals and advance new business ventures and commercial partnerships that will drive economic growth and development both in the United States and Africa. The 2025 U.S.-Africa Business Summit is expected to attract over 1,500 attendees, including African Heads of State, senior U.S. Government officials, CEOs, investors, and entrepreneurs. The event will feature plenary sessions, panel discussions, investment pitch sessions, networking opportunities, and an exhibition showcasing innovative products and services. |