Initially published – September 25, 2023, 3:43 am – updated June 28, 2024

🌍RISE OF CHINESE CARS OUTSIDE OF CHINA

The race to win: How automakers can succeed in a post-pandemic China – August 13, 2021 | Report

🚗

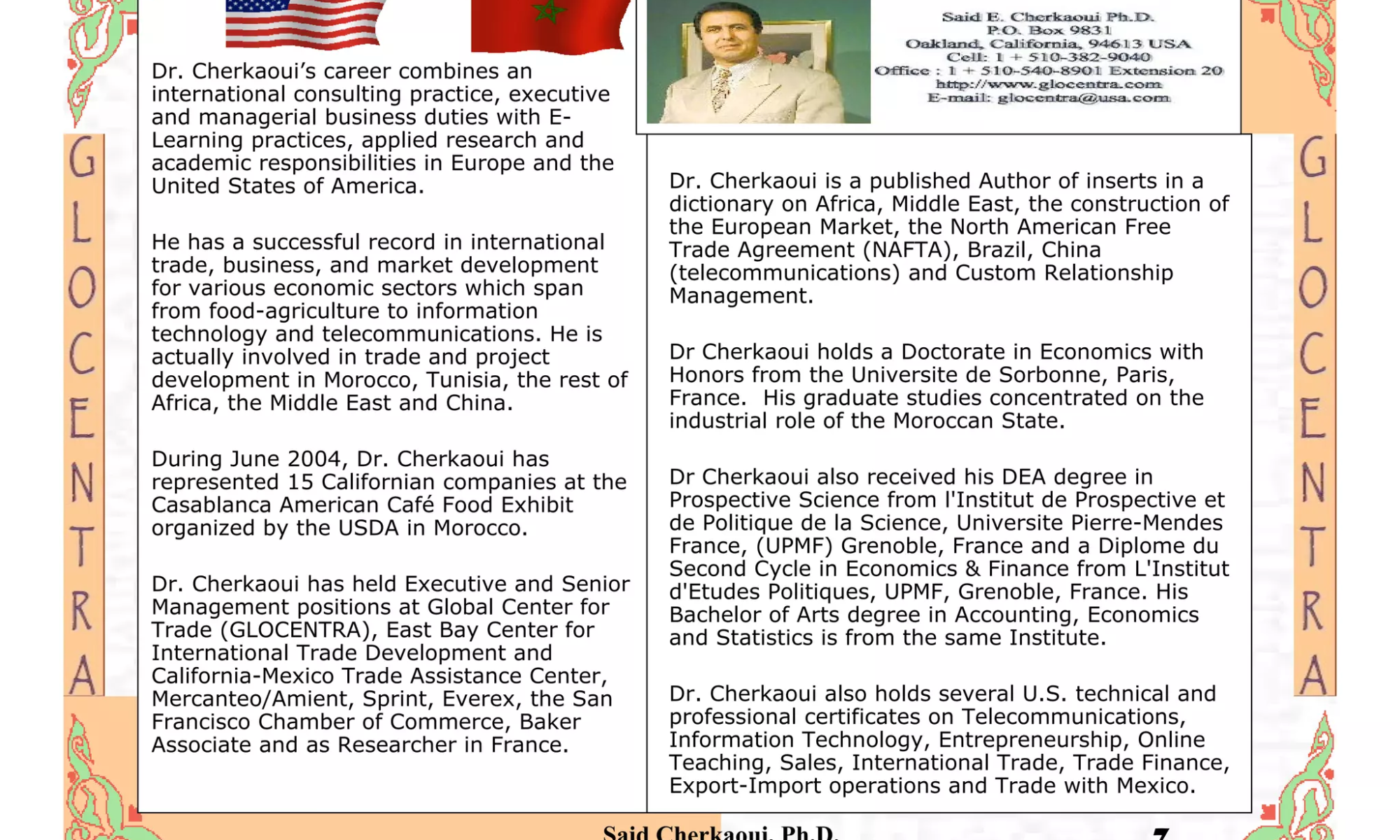

Said El Mansour Cherkaoui Ph.D. ★ Email: saidcherkaoui@triconsultingkyoto.com

Said El Mansour Cherkaoui – Said Cherkaoui – saidcherkaoui@triconsultingkyoto.com

Introduction

How do U.S. car producers based in the United States, other foreign car producers in the United States, European Car Manufacturers selling cars in the United States, and other Asian car producers selling or/and manufacturing cars in the United States, all these car manufacturers react and consider the arrival, establishment and expansion of Chinese made cars and Chinese EV cars and trucks and buses in the United States and Europe and Africa, Latin America and the Middle East.

What is going to be the scenario, the new global, local, regional, and national trends and perspectives of the competition in the car industry around the world given the rise of Chinese Cars

Chinese car brands still need to be added to the US market, but Chinese-made cars are still sold in the US.

• Americans bought 104,000 Chinese-made cars in 2023 and nearly 28,000 in the first quarter of 2024.

• Buick, Lincoln, Polestar, and Volvo all sell US cars made in China.

What some people may not realize, however, is that tens of thousands of cars manufactured in China are sold in the US every year. Volvo’s S60L sedan was one of the first Chinese-made cars to be sold in the US starting in 2016, followed by Buick’s Envision SUV and Cadillac’s CT6 hybrid.

US consumers purchased more than 104,000 Chinese-made vehicles in 2023, up 45% from 2022. Americans bought another 28,000 Chinese-made cars during the first quarter of 2024.

Buick, Lincoln, Polestar, and Volvo sell Chinese-made vehicles in the US. Of those, the only Chinese-made EVs come from Polestar, a brand owned by Volvo and its parent company, Geely. The EV brand imported just 2,217 cars in the first three months of 2024. Polestar is expected to start production in South Carolina this year. Will the U.S. government discourage the domestic output of Polestar? Source: Gene Detroyer

Global Rise of Chinese Cars

Shocks from China Gets Chills to Ford and $9.2B for EV batteries

It’s another landmark day for domestic EV battery manufacturing in the U.S.! Today, LPO announced a conditional commitment for a loan of up to $9.2 billion to BlueOval SK, LLC (BOSK) for the construction of three manufacturing plants to produce batteries for Ford Motor Company’s future Ford and Lincoln electric vehicles (EVs). This marks the eighth conditional commitment for a loan—and the largest-ever to date—that LPO has announced in the last 15 months under the Advanced Technology Vehicles Manufacturing (ATVM) loan program, with two of those loans having since been finalized and issued:

Together, the plants, one located in Tennessee and two in Kentucky, will enable more than 120 gigawatt hours of U.S. battery production annually and displace more than 455 million gallons of gasoline per year for the lifetime of the vehicles powered by these batteries. The project is expected to create a total of approximately 5,000 construction jobs in Tennessee and Kentucky, and 7,500 operations jobs once the plants are up and running.

This effort supports President Biden’s Investing in America agenda to onshore and re-shore domestic manufacturing of technologies that are critical to reaching a clean energy and transportation future. Expanding domestic production of American-made batteries is critical to reaching the Biden-Harris Administration’s goals to have EVs represent at least 50% of all new car sales in the U.S. by 2030, reach net-zero electricity by 2035, and a net-zero economy by 2050.

As with all conditional commitments that LPO offers, it’s important to note that the expected U.S. Department of Energy (DOE) loan will only be issued pending the satisfaction of certain conditions, including final legal, contractual, technical, and financial requirements that the conditional commitment specifies.

www.energy.gov • 3 min read – 6/22/2023

Uncle Sam’s clean-energy push is giving Ford a major boost. The Energy Department has awarded the automaker a massive $9.2 billion loan to fund the construction of three EV battery plants.

a move Bloomberg reports is « by far the biggest government backing for a U.S. automaker since the bailouts in the 2009 financial crisis. »

The U.S. is trying to reduce its battery reliance on China, which has dominated the market for years and has roughly 80% of the world’s manufacturing capacity. Ford, which made about 132,000 EVs in 2022, hopes to produce 2 million of the vehicles by 2026.

The plants — two in Kentucky, one in Tennessee — are already in the works as part of BlueOval SK, a partnership between Ford and South Korean battery firm SK On. The total projected cost is $11.4 billion.

The U.S. Energy Department said Thursday it plans to lend up to $9.2 billion to a joint venture of Ford Motor and South Korea’s SK On to help it build three battery plants in Tennessee and Kentucky, a record-setting loan for a vehicle supply chain project. The conditional commitment for the low-cost government loan for the BlueOval SK joint venture comes from the government’s Advanced Technology Vehicles Manufacturing (ATVM) loan program. Jigar Shah, the head of the loan program office, told Reuters the loan could close as soon as within 10 weeks.

SCOOP: Ford Motor Company & South Korean battery maker SK On are getting a $9.2 billion loan from the US Department of Energy for three battery plants under construction in Kentucky & Tennessee. It’s a watershed moment in the US race to catch China in green vehicle technology.

Community colleges in Tennessee and Kentucky stand to benefit from the government’s $9B+ investment in battery production. New workforce development and academic programs, as well as re-tooled facilities, will be needed to support the 7,500 operations jobs associated with these new plants.

Blade Batteries

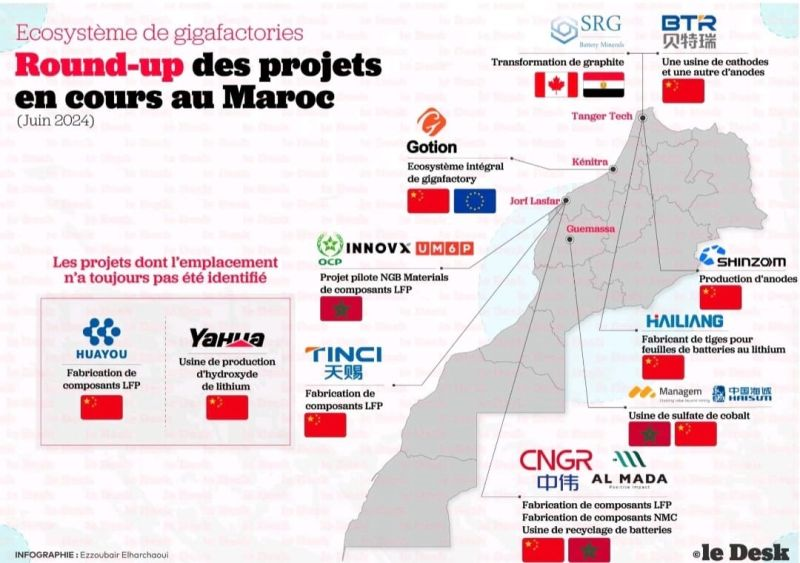

Global Delocalization of Batterie Manufacturers: Example of Morocco

Let us quickly recall here the advantages which attract investments in new technologies within the countries of the South both from China and from Western countries or other nationalities aiming to relocate certain phases of their production.

The cost of intermediate production, the cost and local availability of raw materials, labor, the proximity of car suppliers and buyers, financial facilities and tax incentives, the flexibility of pollution laws, flexibility of work, the docility of social demands movements, and the rate of social charges and recovery of retirement pensions, health insurance as well as the level of unionization, the cost of land ownership and supply of these lands by the State, the level of logistical infrastructure, the ease of movement of capital, taxation and the rate of social charges and recovery of retirement pensions as well as the level of unionization, remittance and export profits as well as the company’s appropriation ratio. Not to mention the integration of operators and managers from the country of origin benefiting from all the financial and tax advantages recognized by the public authorities. 1/7/2024

First Batch of SHACMAN X6000 Series Products Rolled off the Assembly Line. Congratulations.

Asian Firms to build joint LFP cathode plants in Morocco

South Korea’s LG Chem Ltd

South Korea’s LG Chem Ltd (051910.KS) has entered a partnership with China’s Huayou Group’s subsidiary Youshan, project to build a joint electric vehicle (EV) battery material plant in Morocco to diversify its portfolio.

The Morocco plant, set to start production in 2026, aims to produce 50,000 tonnes of lithium-phosphate-iron (LFP) cathode materials annually, enough to be installed in 500,000 entry-class EVs, the South Korean chemical maker said in a statement.

Huayou has joined the growing number of Chinese electric vehicle and battery companies seeking to expand overseas to get closer to their foreign clients and benefit from local incentives.

In a separate statement, Huayou’s listed unit Zhejiang Huayou Cobalt Co (603799.SS) said it intended to build plants with LG Chem in Indonesia and Morocco under a strategic partnership to promote international growth.

The Morocco plant, set to start production in 2026, aims to produce 50,000 tonnes of lithium-phosphate-iron (LFP) cathode materials annually, enough to be installed in 500,000 entry-class EVs, the South Korean chemical maker said in a statement.

LG Chem, known for manufacturing more expensive nickel-cobalt-manganese (NCM) cathodes, is entering the LFP cathode business to meet the growing demand for cheaper LFP batteries as the auto industry seeks to produce more affordable EVs, whose most expensive components are the batteries.

LG Chem said LFP cathodes produced at the Morocco plant will be supplied to the North American market and could be eligible to receive subsidies from the U.S. Inflation Reduction Act (IRA) as Morocco is a free-trade partner with the United States.

CNGR, Chinese Battery-Parts Maker, and African Fund Al Mada

CNGR, the Chinese Battery-Parts Maker is partnering with the African Fund Al Mada to Plan a $2 Billion Venture in Morocco – The investment volume is about 20 billion Moroccan dirhams (1.8 billion euros). CNGR Advanced Material Co., a Chinese maker of battery components, is joining forces with the African private investment fund Al Mada to build an industrial base in Morocco {9/18/2023} for a battery materials production and recycling facility. The strategic partnership aims to produce ternary CAM precursors for lithium-ion batteries as well as lithium iron phosphate (LFP) and recycle black mass from used batteries. A joint venture has been established between the two companies to advance the project.

Battery material for more than one million EVs per year

Construction is scheduled to begin this year, and phased production is expected to start in the fourth quarter of 2024. The plan is to produce battery material for more than one million electric vehicles per year, with 120,000 tons of CAM precursors, 60,000 tons of LFP, and 30,000 tons of black mass recycling.

Negotiations with leading phosphate and fertilizer supplier

CNGR Morocco New Energy, a subsidiary of CNGR, will hold a majority 50.03 percent stake in the joint venture, while Al Mada’s subsidiary NGI will hold 49.97 percent.

The two partners are currently negotiating with the OCP Group to purchase the necessary raw materials, including phosphate products. Jorf Lasfar is located directly on the Atlantic coast, and a seaport is also available in El Jadida. So far, Jorf Lasfar is known mainly for the country’s largest coal-fired power plant. OCP Group, a leading Moroccan phosphate and fertilizer supply company, sources the highest quality phosphate salts for the production of LFP and ternary CAM precursors from the plant. Morocco is a major global producer of phosphate salts: Its reserves account for 71% of the world total. Other suppliers, such as cobalt and manganese products, are not named in the announcement.

CNGR Advanced Material Al Mada Recycling

The focus will be on producing precursors for NCM and LFP cathode materials. The plant will also include recycling facilities. The companies are planning annual capacities of 120,000 tonnes for NCM precursors, 60,000 tonnes for LFP precursors, and 30,000 tonnes for the recycling of battery materials in the first phase. The planned annual production is 70 GWh. That should be enough for more than one million electric vehicles.

Production is mainly for export to meet the high demand in Europe and America – but the partners do not name potential customers. Construction will begin this year after the necessary permits have been obtained and production is scheduled to start in 2025. Source: Info via email

“Morocco aims to open EV battery gigafactory”

Announced on July 22, 2022, at Marrakesh.

Asian Companies Building Battery Factories in Morocco to export to Europe and the U.S.

During the summer of 2022, the Moroccan Minister of Industry and Trade declared that Morocco was negotiating with electric vehicle battery manufacturers to set up a plant in the country to mesh with its existing automotive sector and cobalt output.

“We hope to sign a deal for the plant before the end of this year,” the minister said in an interview with Reuters but declined to name the companies.

He did not say how much investment it would require but referred to it as a “gigafactory,” a term widely used for very big production facilities. The planned factory for EV batteries will “offer a huge momentum for the local automotive sector” and will benefit from the availability of renewable energy and raw materials such as cobalt and phosphates in the country, he said.

Morocco is home to Renault and Stellantis production plants, with a combined production capacity of 700,000. The Dacia Sandero and Peugeot 208 are examples of popular models that are built in Morocco. Demand for such batteries is growing outside and within Morocco, where Citroen plans to double its production capacity within two years from 50,000 EVs, Mezzour said.

Exports by about 250 automakers and suppliers in Morocco have topped the country’s industrial exports over the past seven years, surpassing phosphate sales. Up to May this year, Morocco’s automotive sector sales stood at $4.13 billion, up 24 percent. To increase competitiveness in the face of competition from China and India, Morocco plans to increase the rate of locally made parts in the cars it exports to 80 percent, up from 65 percent currently, Mezzour said.

“We are targeting 1 million within the next three to four years,” Mezzour said. Source:

And what is Europe doing for its renewable industry?

US Billions are flooding into US-based investments, so even European companies are now moving to the US for their investments.

In 2022, the top five manufacturers control more than 80 percent of the battery market. With an increased interest in EVs – global sales of electric cars totaled 4.2 million units in 2021, up by 108 percent compared with 2020 – there’s been concern that a long list of car companies may soon face an EV battery shortage from electric car battery manufacturers.

The advantages which attract investments in new technologies within the countries of the South both from China and from Western countries or other nationalities aiming to relocate certain phases of their production. The cost of intermediate production, the cost and local availability of raw materials, labor, the proximity of car suppliers and buyers, financial facilities and tax incentives, the flexibility of pollution laws, flexibility of work, the docility of social demands movements, and the rate of social charges and recovery of retirement pensions, health insurance as well as the level of unionization, the cost of land ownership and supply of these lands by the State, the level of logistical infrastructure, the ease of movement of capital, taxation and the rate of social charges and recovery of retirement pensions as well as the level of unionization, remittance and export profits as well as the company’s appropriation ratio. Not to mention the integration of operators and managers from the country of origin benefiting from all the financial and tax advantages recognized by the public authorities.

1/7/2024

LG Energy Solution

A unit of LG Chem, this South Korean battery supplier is neck and neck with CATL as the world’s number one supplier of lithium-ion EV batteries.

Although there has been some controversy along the way – LG Chem successfully sued rivals SK Innovations not too long ago for stealing trade secrets – the future looks bright for the company, with LG Energy Solution beginning production of 4680 cells in 2023, the very same cells which make up Tesla’s most advanced battery pack yet.

The large format 4680 cylindrical cells are said to increase power by six times and energy by five times, as well as boost an EV’s range by up to 54 percent.

These 4680 cells are also expected to bring the price of Tesla EVs down to around $US25,000, according to Tesla founder Elon Musk.

The company also has a US$303 million plant in Holland, Michigan, capable of producing enough cells per year to build between 50,000 and 200,000 battery packs for EV and hybrid manufacturers like Ford, General Motors, Hyundai, Volvo, Renault and Chevrolet.

By 2025, all factories in South Korea, North America, Europe, and China will operate on 100 percent renewable energy.

BYD

Once written off by Elon Musk, China’s BYD has proven the haters wrong by becoming the world’s top seller of EVs in July 2022, having sold 641,000 vehicles in the first half of 2022 – nearly 80,000 more EVs than Tesla.

Although it’s gained a strong footing in the EV market, BYD began life as a rechargeable battery manufacturer in 1995, and in 2021 it built a new facility in Chongqing, China, to produce its blade batteries, which are thinner and longer than conventional lithium-ion cells.

Blade batteries are also considered to be the safest EV batteries because they are far less likely to catch fire in an accident. They are also 50 percent smaller than other battery blocks, resulting in lighter and more efficient EVs.

There seems to be no hard feelings between the Chinese behemoth and Elon Musk: BYD executive vice president Lian Yubo now says BYD is “good friends” with Mr Tesla, and has plans afoot to supply his company with EV batteries.

Panasonic

Panasonic is another of the world’s largest lithium-ion battery manufacturers, the electronics giant partnering with Tesla on Giga Nevada – or Gigafactory 1, as it’s also known – a $5 billion lithium-ion battery and electric vehicle component factory located in Storey County, Nevada, which produces a Panasonic EV battery exclusively for Tesla’s Model 3, Model S and Model X SUV.

Panasonic is said to have invested US$1.6 billion in Gigafactory 1 to make itself Tesla’s prime supplier of EV batteries, with raw materials being supplied by a mining company that extracts lithium from a site located 320km away from the factory.

Jointly designed and engineered by Tesla and Panasonic, the ‘2170’ battery has been in mass production since January 2017, with the new and improved 4680 battery cell, which has significant capacity improvements, going into production in 2023.

Turning an eye to the future, Shoichiro Watanabe, CTO of Panasonic Energy, says the company will achieve a 20 percent improvement in energy density in its battery cells by the end of the decade.

In much the same way that Tesla has partnered with other EV battery manufacturers in other international markets, Panasonic has also partnered with Toyota to build a lithium-ion battery plant in Japan that will supply batteries for Toyota EVs. Source:

Present Outlook of the World Battery Manufacturing Capacity

With the world gearing up for the electric vehicle era, battery manufacturing has become a priority for many nations, including the United States. However, having entered the race for batteries early, China is far and away in the lead.

This was originally posted on Elements.

Predominance of China’s World Manufacturing Capacity

– China controls raw materials –

Another key factor in China’s supremacy: is control over the raw materials needed to manufacture the batteries: lithium and cobalt.

According to Bloomberg, the Chinese firms Ganfeng and Tianqi control 17 and 12 percent respectively of the world production of lithium thanks to their investments in mines in Australia and South America.

Tianqi bought a 24 percent stake in Chilean miner SQM for $4.1 billion in December 2018. Together with the US firm Albemarle it also controls the huge Greenbushes mine in Australia.

Meanwhile, Chinese firms control at least half of the cobalt extracted in the Democratic Republic of Congo, where 70 percent of global output comes from, according to estimates cited by Bloomberg.

China Molybdenum bought a major site from the US firm Freeport-McMoran for $2.65 billion in 2016. China also has 80 percent of the world’s capacity to produce refined cobalt using chemical processes.

This is not a basic skill (“We are a car manufacturer, not chemically,” said Marianne Battalion, Renault E’s project manager last year), but second, whether the production was outsourced to Koreans or Chinese, many unemployed motor factories instead.

China has 6 of the top 10 EV battery makers with 60 percent market share, led by CATL and Warren Buffett-backed BYD.

- Besides CATL and BYD, CALB, Gotion High-tech, Sunwoda, and Eve Energy feature among the world’s top 10 EV battery makers, according to SNE Research

- CATL installed 165.7 gigawatt hours of battery cells in the first 11 months of last year, giving it a global market share of 37.1 percent

China’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity. With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021.

The U.S. is projected to increase its capacity by more than 10-fold in the next five years. EV tax credits in the Inflation Reduction Act are likely to incentivize battery manufacturing by rewarding EVs made with domestic materials. Alongside Ford and General Motors, Asian companies including Toyota, SK Innovation, and LG Energy Solution have all announced investments in U.S. battery manufacturing in recent months.

Europe will host six of the projected top 10 countries for battery production in 2027. Europe’s current and future battery plants come from a mix of domestic and foreign firms, including Germany’s Volkswagen, China’s CATL, and South Korea’s SK Innovation.

Combating China’s dominance will be expensive. According to Bloomberg, the U.S. and Europe will have to invest $87 billion and $102 billion, respectively, to meet domestic battery demand with fully local supply chains by 2030.

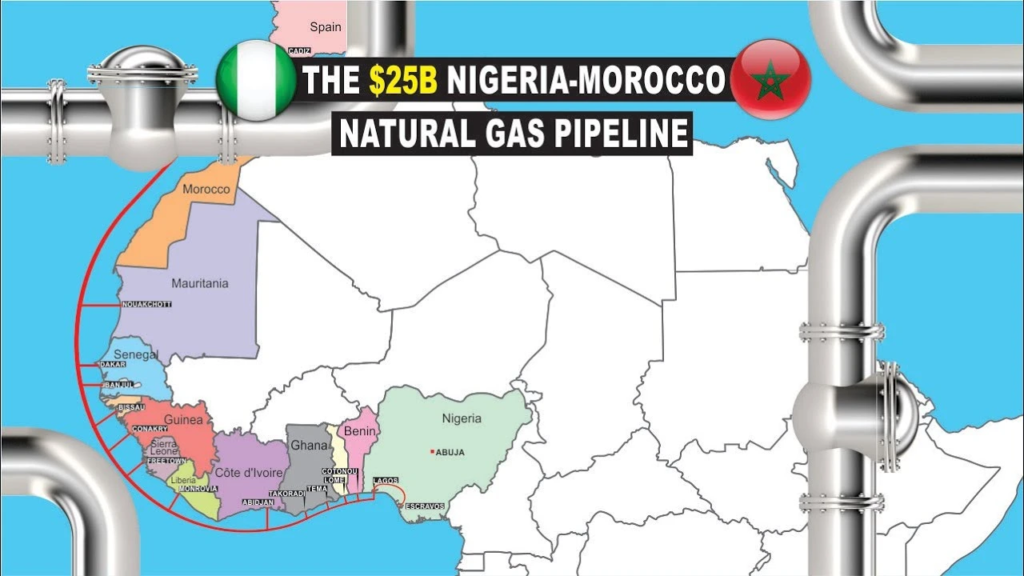

Within such an unbalanced world of Battery Manufacturing Capacity and given that Europe is using a mixed approach, Morocco is positioned to benefit from Europe’s reliance on domestic and foreign manufacturers of batteries.

Morocco, Regional Hub for Battery Material Plants

South Korea’s LG Chem partnering with China Huayou Group announced a project to build in Morocco a joint electric vehicle (EV) battery material plant. On the other side, CNGR, Chinese Battery-Parts Maker, and African Fund Al Mada aim to build an industrial base in Morocco for a battery materials production and recycling facility. All the Production of these facilities is intended for export to meet high demand in Europe and America.

🇺🇸🚗- 🌍 AFRICANA🌍 ENTERPRISE🌍 – 🌐Morocco🌍Tech🌐 –

African-Moroccan Diaspora – Tateyoko Research Institute – USA – Tateyoko Research Institute

Articles Similaires

https://www.energy.gov/lpo/listings/projects

• What is a Conditional Commitment? https://www.energy.gov/lpo/articles/getting-know-lpo-what-conditional-commitment

• Advanced transportation project financing available through LPO’s Advanced Technology Vehicles Manufacturing (ATVM) loan program: Energy.gov/LPO/ATVM

• President Biden’s « Investing in America » agenda: https://www.whitehouse.gov/invest

President Biden: Road of Jérusalem Passe par l’Usine Ford de Dearborn – Mai 19, 2021 – DANS “ETATS-UNIS D’AMÉRIQUE”

Read more below via Ars Technica.

Read the full BlueOval SK project conditional commitment announcement for more details: https://www.energy.gov/lpo/articles/lpo-announces-conditional-commitment-loan-blueoval-sk-further-expand-us-ev-battery

The Mexican-Japanese-US Model for Auto Assembly in Northern Mexico – September 29, 2020 – “AUTOMOBILE INDUSTRY”

Global Liberalism and U.S. State Interventionism: Electric Auto Industry – Mai 19, 2021 – “ELECTRIC VEHICLE”

Selected articles written and published by Said El Mansour Cherkaoui – Said Cherkaoui on the Automobile industry in Morocco

Contact: saidcherkaoui@triconsultingkyoto.com

Globaloganization of Renault Development Strategy

🌎 Said El Mansour Cherkaoui February 20, 2023 – saidcherkaoui@triconsultingkyto.com🌍 🌎Analyses et Publications sur l’Industrie Automobile🌍 Said El … Continue reading

Automotive Industry: Regional Versus International Strategy

Said El Mansour Cherkaoui June 21, 2023, N.B.: Frontpage picture of the Blue Car in the First Floor Parking taken by Said El Mansour Cherkaoui … Continue reading

Morocco – Maroc – BAGNOLE CHERKAOUI 1920 – 24

Articles traitant de Morocco – Maroc écrits par Said El Mansour Cherkaoui

https://bagnolecherkaoui.wordpress.com/category/morocco-maroc/

Cahiers d’économie politique, n°13, 1987. Conceptions de la monnaie : un enjeu théorique.

Cahiers d’économie politique, n°13, 1987. Conceptions de la monnaie : un enjeu théorique.

![Economie monetaire s3 [learneconomie.blogspot.com]]](https://image.slidesharecdn.com/economiemontaireetfinancire-www-160503175230/95/economie-monetaire-s3-learneconomieblogspotcom-80-638.jpg?cb=1462297978)