05 July 2023

Summary of the UNCTAD’s World Investment Report 2023

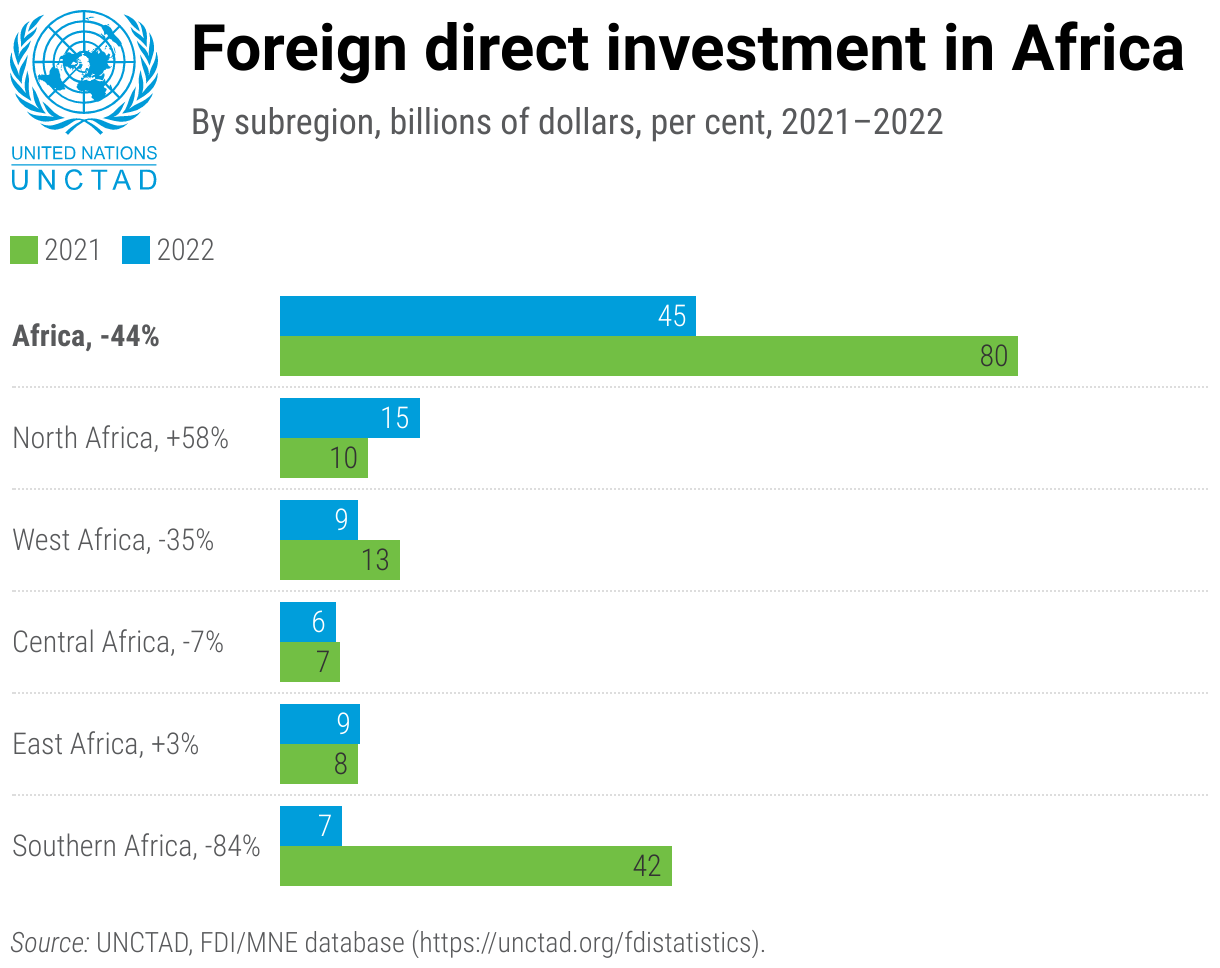

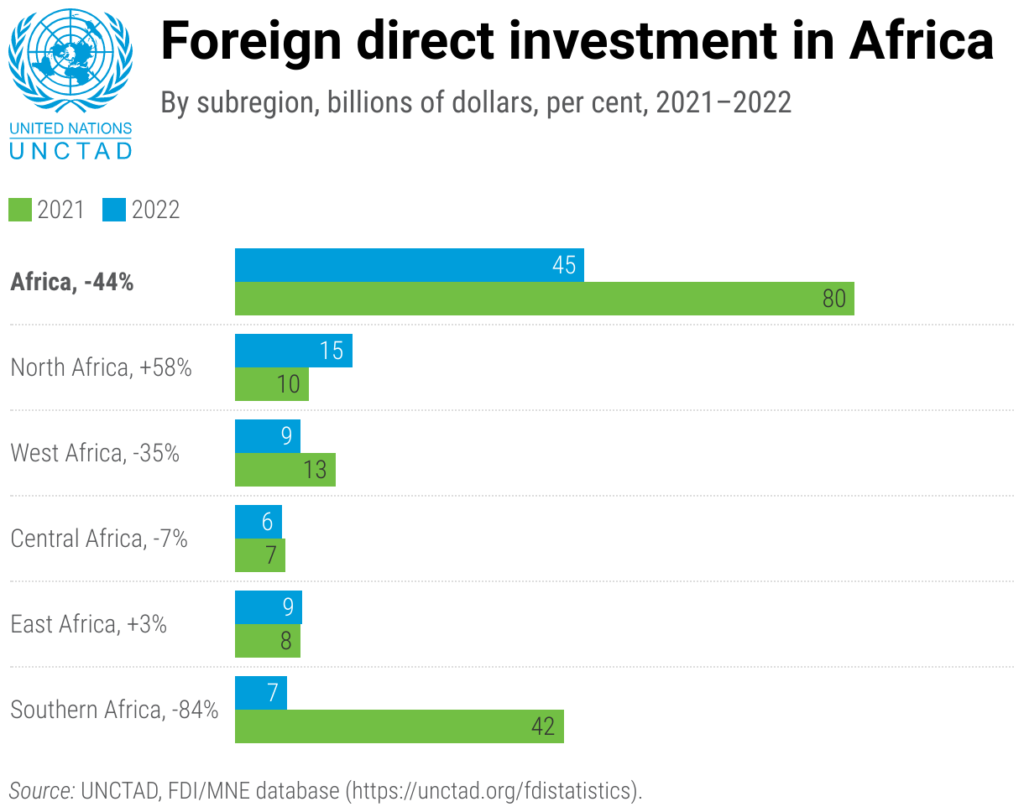

Investment flows to Africa dropped to $45 billion in 2022

- 07/11/2023 – Foreign direct investment: the increase in 2022 in developing countries does not benefit Africa

- 07/06/2023 – Africa: foreign direct investment flows fell by 44% in 2022 (UNCTAD)

- 06/14/2023 – Chinese direct investment in Africa totaled $3.4 billion in 2022

The report also indicates that the African continent received foreign investments totaling $52.63 billion in 2023, down 3% from 2022.

In terms of cumulative FDI stocks, the main economies investing in Africa are the Netherlands, France, the United States, the United Kingdom, and China.

Globally, FDI declined by 2% over the past year to $1.3 trillion. This decline is due to increased trade and geopolitical tensions in the context of a slowdown in the global economy.

For 2024, UNCTAD notes that the outlook for FDI remains challenging in 2024. However “modest growth for the year as a whole seems possible”, citing factors such as easing financial conditions and concerted efforts to facilitate investment.

According to UNCTAD’s World Investment Report 2023, international project finance deals targeting Africa showed a decline of 47% in value.

UNCTAD’s World Investment Report 2023 published on 5 July shows that foreign direct investment (FDI) flows to Africa declined to $45 billion in 2022 from the record $80 billion set in 2021. They accounted for 3.5% of global FDI.

The number of greenfield project announcements rose by 39% to 766. Six of the top 15 greenfield investment megaprojects (those worth more than $10 billion) announced in 2022 were in Africa.

In North Africa, Egypt saw FDI more than double to $11 billion as a result of increased cross-border merger and acquisition (M&A) sales.

Announced greenfield projects more than doubled in number, to 161. International project finance deals rose in value by two-thirds, to $24 billion. Flows to Morocco decreased slightly, by 6%, to $2.1 billion.

In West Africa, Nigeria saw FDI flows turn negative to -$187 million as a result of equity divestments. Announced greenfield projects, however, rose by 24% to $2 billion. Flows to Senegal remained flat at $2.6 billion. FDI flows to Ghana fell by 39% to $1.5 billion.

In East Africa, flows to Ethiopia decreased by 14% to $3.7 billion; the country remained the second-largest FDI recipient on the continent. FDI to Uganda grew by 39% to $1.5 billion on investment in extractive industries. FDI to Tanzania increased by 8% to $1.1 billion.

In Central Africa, FDI in the Democratic Republic of the Congo remained flat at $1.8 billion, with investment sustained by flows to offshore oil fields and mining.

In Southern Africa, flows returned to prior levels after the anomalous peak in 2021 caused by a large corporate reconfiguration in South Africa. FDI in South Africa was $9 billion – well below the 2021 level but double the average of the last decade. Cross-border M&A sales in the country reached $4.8 billion from $280 million in 2021. In Zambia, after two years of negative values, FDI rose to $116 million.

Four regional economic groupings see growth

Over the past five years, FDI inflows have risen in four of the regional economic groupings on the continent.

FDI in the Common Market for Eastern and Southern Africa grew by 14% to $22 billion. Flows rose also in the Southern African Development Community (quadrupling, to $10 billion), the West African Economic and Monetary Union (doubling, to $5.2 billion), and the East African Community (up 9%, to $3.8 billion).

Intraregional investment remained relatively small, despite an increase over the past five years. In 2022, intraregional greenfield project announcements represented 15% of all projects in Africa (2% in terms of value), as compared with 13% (2% in value) in 2017.

However, looking at announced projects invested in by only African multinational enterprises, three-quarters of their value remained on the continent.

In 2022, the biggest increase in announced greenfield projects was in energy and gas supply (to $120 billion from $24 billion in 2021). Project values in construction and extractive industries also rose, to $24 billion and $21 billion, respectively. The information and communication sector registered the highest number of projects.

International project finance deals targeting Africa showed a decline of 47% in value ($74 billion, down from $140 billion in 2021) but a 15% increase in project numbers, to 157.

European investors remain, by far, the largest holders of FDI stock in Africa, led by the United Kingdom ($60 billion), France ($54 billion) and the Netherlands ($54 billion).

The report highlights that the flow of foreign direct investment to Africa decreased by 3% over the past year to less than $53 billion.

Egypt is the African country that attracted the most foreign direct investment (FDI) in 2023, according to a report published on Thursday, June 20, 2024, by the United Nations Conference on Trade and Development (UNCTAD).

Entitled “World Investment Report 2024”, this report specifies that this North African country attracted FDI flows of $9.84 billion, despite declining mergers and acquisitions compared to the peaks reached in 2022.

The most populous country in the Arab world is followed by South Africa ($5.23 billion), Ethiopia ($3.26 billion), Uganda ($2.88 billion), Senegal ($2.64 billion), Mozambique ($2.50 billion), Namibia ($2.34 billion) and Nigeria ($1.87 billion). Côte d’Ivoire closes the top 10 with FDI flows of $1.75 billion in 2023.

Listing of 20 African countries with the most FDI in 2023