In many ways, the case is clear. Nearshoring or onshoring can contribute to risk-resistant supply chains and lead to faster time-to-market, more effective planning cycles, and greater flexibility in response to disruption. Proximate sourcing can enable greater control and more frequent site visits, fewer cultural barriers, and better communication. Reductions in logistics costs and lead times can also bolster the balance sheet by freeing up working capital that is tied up in cash outlays to suppliers and inventory in transit.

Colliers International releases a new research report on the latest trends for the manufacturing industry in Asia, Europe and the Americas

Greater focus on automation and digital technology in manufacturing globally is helping to shift workforce needs from low-cost to highly-skilled. This trend is apparent across Europe, and globally, according to a report released by Colliers International. The report discusses multiple pressures which global manufacturing and supply chains are confronting.

“To remain competitive in a global context and future-proof their manufacturing sector, advanced economies are embracing the Fourth Industrial Revolution and pioneering new forms of smart manufacturing whereby production combines the “Internet of Things” and digital technology to increase productivity, efficiencies and flexibility. Germany for example pursues this objective through its “Industrie 4.0” programme”. Commented Tim Davies, Managing Director, Head of Industrial & Logistics Practise Group for Colliers EMEA.

While this is putting greater emphasis on the quality rather than the quantity of the workforce in advanced economies, low-cost manufacturers remain an important part of the global manufacturing jigsaw. They are seeing their operations shift into less advanced economies, where labour costs are low and supply is more plentiful.

Karel Stransky, Director, EMEA Corporate Solutions: “Europe ultimately needs additional workers to avoid significant labour shortages. EU states in the Organisation for Economic Cooperation and Development (OECD) are anticipating population declines of approximately 10% by 2050, while the EU dependency ratio is expected to double, a measure reflecting the pressure on the productive population. Rural areas will be the most affected due to the continuing urbanisation trend. This begs a question over the sustainability of local labour pools. Going forward, the countries that will emerge as manufacturing winners will be those who continue to create innovative technologies in the most cost-effective manner, combined with competitive, yet affordable, wages.”

CEE has been one of the main beneficiaries of new productive investment in Europe in the last few decades. This has been primarily focused on a group of so-called Tier 1 countries including the Czech Republic, Poland, Slovakia and Hungary. The Czech Republic has one of the highest stocks of manufacturing FDI (Foreign Direct Investment) per capita within CEE. This investment has put local labour markets under pressure.

The Czech unemployment rate has fallen from a post crisis peak of 7.3% in 2010 to 5.1% in 2015 and is expected to fall to just above 4% by the end of 2016, the lowest level in Europe. In Poland, another regional heavyweight, the unemployment rate is predicted to fall to an all-time low of 6.2% by the end of the year.

Meanwhile, gross average manufacturing wages have increased by nearly 50% in the Czech Republic, 57% in Slovakia, 68% in Poland and 73% in Hungary in the space of less than 10 years (2005 to 2014).

These cyclical and structural forces are slowly redrawing the manufacturing landscape across the CEE region as we know it, and are prompting some corporates to consider alternative territories to established manufacturing hot spots.

The report – ”Global Manufacturing Shifts: an EMEA Perspective. Production in the post-BRICs era” cites several significant factors and trends as catalysts for redrawing the manufacturing landscape:

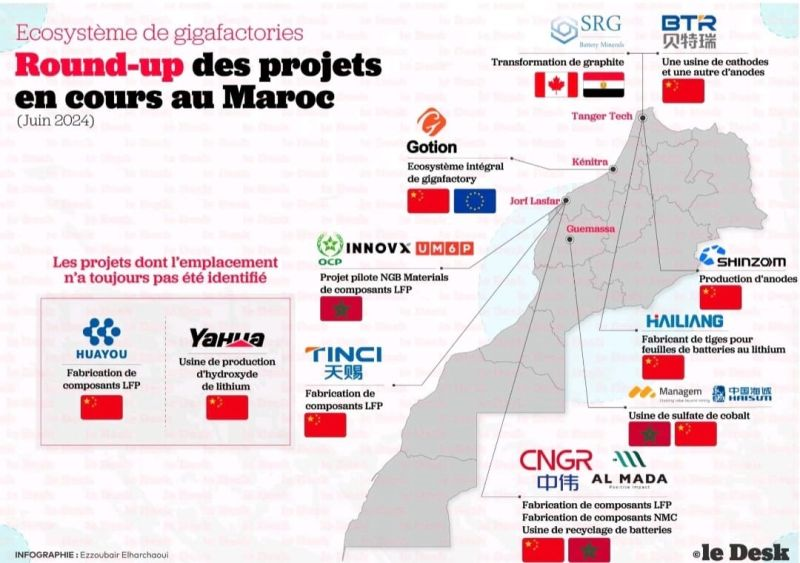

- Rising labour costs and labour shortages in global manufacturing hot spots are redefining the map of global manufacturing, driving growth into the next group of low cost countries such as South Eastern Europe, Turkey and Morocco.

- Labour costs are far from being the only determining factor for locating a site or plant or in product-sourcing decisions. The need to improve speed to market and the growing demand for customised product means proximity to final consumers is increasingly important. As a result, regions/countries close to major consumer blocks that offer a good balance between cost/risk are those best placed to benefit from this trend. These include the previously mentioned countries plus South East Asia and Mexico.

- In line with Industry 4.0, Western European supply chains are set to become increasingly automated, with robot-operated factories the norm. Port operator APM Terminals, for example, recently announced the opening of the world’s first fully-automated container in Rotterdam Port. Amazon has cut its operating expenses by about 20% by using its Kiva robots, and plans to roll out this technology more extensively across Europe and Asia.

- Automation and technology may also enable the return of some traditionally labour intensive productions, from farther afield, as they seek to maximize speed to market. While this will generate new real estate requirements, the overall impact on job markets is likely to be more muted and unevenly felt across skills/qualifications levels, with the low-skilled workforce set to be most impacted.

- In CEE, tier 1 markets like Poland and the Czech Republic have become more expensive and increasingly saturated in their primary manufacturing locations. This is likely to pave the way to greater manufacturing investment, particularly by cost-sensitive industries, into “off-the beaten track” regions within these countries or deeper into South Eastern Europe and the Balkans region. Labour cost will be a key driver, with current infrastructure development across the region helping de-risk investment. EU enlargement on other hand seems to have lost momentum but remains important in the mid-long term.

- Mediterranean countries like Turkey and Morocco are likely to capture some investment thanks to their large, young and educated workforce and their location at the crossroads of Europe and other emerging regions like Africa and the Middle East. Turkey in particular is the Western’ terminal of China’s Silk Road initiative, aimed at strengthening trade between the Far East and Europe and support China’s outward investment.

Formation Entrepreneuriale a l’Américaine en Concept, en Gestion et en Définition Opérationnelle et Productive:

English Version: https://triconsultingkyoto.com

Version Française: https://fr.consultingkyoto.com

Entrepreneurs, small and mid-sized firms, minority and women-owned companies Insights on International Trade and Business Operations YOU ARE PREPARING YOUR FUTURE EXPORT ACTIVITY TRI CK USA will help you select your target countries TRI CK USA will define and conduct a diagnosis to validate your export potential. TRI CK USA will help you develop your … Continue readingWE DELIVER @ TRI CK USA

TRI CK USA – TRI CONSULTING KYOTO CALIFORNIA

Entrepreneurs, small and mid-sized firms, minority and women-owned companies

From the Land of the Silicon Valley, the Bay Area of San Francisco, and the Oaktown of Oakland East Bay, we offer the leading services, support, and guidance to regional, local, and multinational businesses, governmental organizations, and professional representative entities and academic institutions for the last 35 years.