Updated on 8/2/2024 – Initial publication on 9/6/2022

The #Intel earnings report with key facts and figures:

Revenue Miss: Intel significantly missed analyst expectations for the third quarter. Revenue is expected to be $12.5 billion to $13.5 billion, lower than the estimate of $14.38 billion.

EPS Miss: The company projects a loss of 3 cents a share loss per share, compared to the expected profit of profit 30 cents.

Job Cuts and Dividend Suspension: To address these challenges, Intel is planning to cut more than 15% of its workforce (Total workforce around 110,000 people) and suspend dividend payments starting in the fourth quarter.

Competitive Landscape: Intel is struggling to keep pace with competitors like Nvidia (more than twice in sales) and AMD (more than $100 billion higher valuation). TSMC is also recognized for having industry’s best production.

Gelsinger’s Outlook and Spending Cuts: Despite these setbacks, CEO Pat Gelsinger remains confident in Intel’s long-term strategy. He believes their manufacturing will catch up to rivals (catch and pass those of rivals) and justify new plant construction.

However, Intel is reducing spending on new plants and equipment (more than 20%) with a new budget of $25 billion and $27 billion in 2024 and $20 billion and $23 billion in 2025.

Stock Performance: Intel’s stock price fell sharply (more than 17%) in after-hours trading, extending its year-to-date decline to more than 42%.

Overall, Intel is facing significant challenges in the third quarter, including lower-than-expected revenue and earnings. The company is taking steps to address these challenges, such as cutting costs and reducing capital expenditures. However, these cuts may not be enough to offset the competitive pressures that Intel is facing.

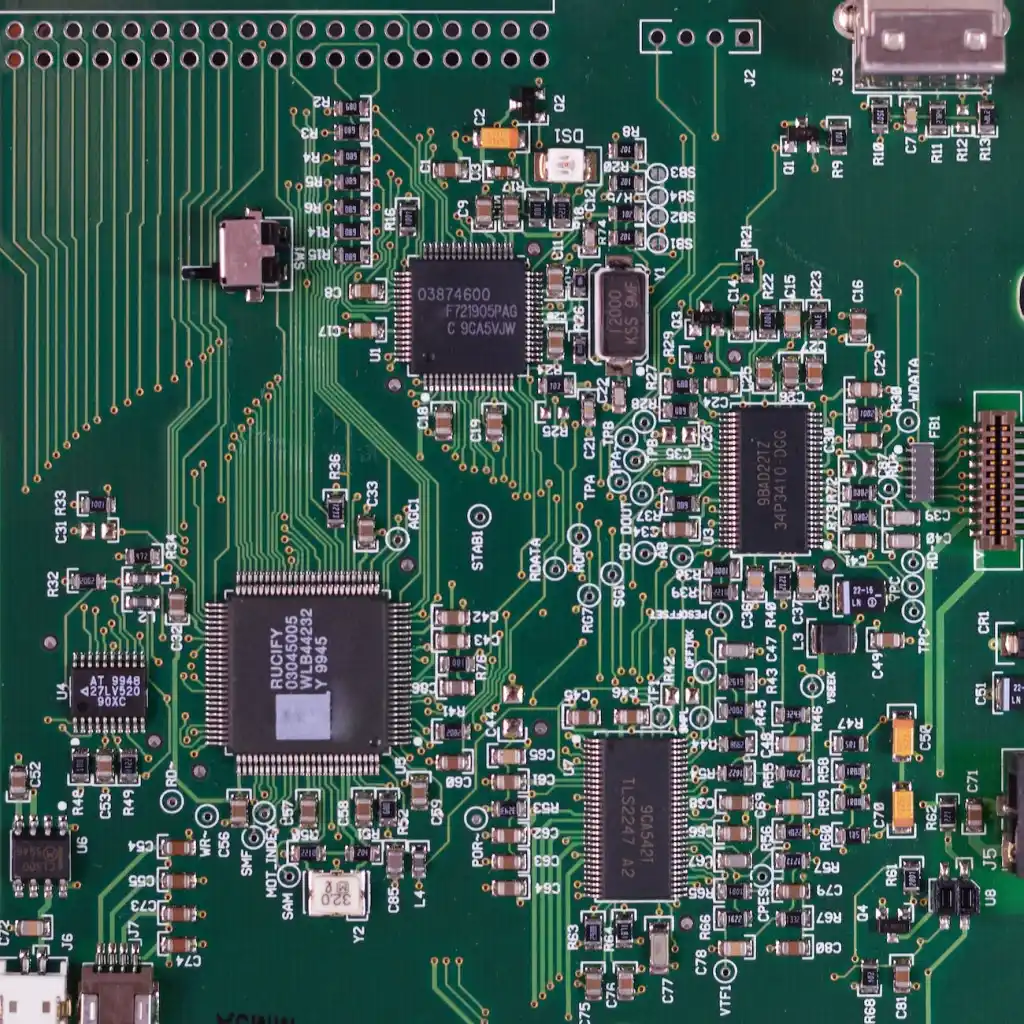

Microchips, 21st Century Black Gold and US Plan $50 Billion Investment in CHIPS

NVIDIA Corporation (NASDAQ: NVDA), Advanced Micro Devices Inc (NASDAQ: AMD), and Broadcom Inc. (NASDAQ: AVGO) are some of the major players in the semiconductor industry in the US.

High Tech Competition and Geo-Political Encounter

On a diplomatic trip to Taiwan as tensions with Beijing are at their highest, U.S. Speaker of the House of Representatives Nancy Pelosi visited a semiconductor factory. The production of these essential components of electronic chips, on which modern computing is based, is at the heart of major #strategic issues. In retaliation for the visit of the American representative, #China has stopped its exports of natural sand (silica) to Taiwan, a mineral which happens to be an essential ingredient in the manufacture of… semiconductors.

As figures from the Comtrade database show, Taiwan is a champion in this area. In 2020, the latest year for which complete data is available, the value of its microchip exports was over $120 billion, slightly more than its gigantic neighbor China, whose shipments are estimated at $117 billion. If China, Hong Kong, and Taiwan are taken together, the value of exports from the region (nearly $400 billion in 2020) represents around half of the global total.

That year, the U.S. exported chips worth around $44 billion, three times less than Taiwan, but still enough to rank seventh in the world in a market dominated by Asia. In 1990, the United States still produced almost 40% of world demand, and Europe about as much. But the arrival on the market of South Korea, Taiwan, and then China in the 2000s, quickly changed the landscape. In 2020, the United States and Europe together accounted for only around 20% of global production.

With the global supply chain disruptions and shortages that have taken place during the pandemic, several countries have launched initiatives to restart the production of these strategic components in their territory. Before the United States, Japan and the European Union have already announced measures to relocate semiconductor manufacturing.

AFRICAN RESEARCHERS, ENGINEERS, INDUSTRY CAPTAINS, FINANCIERS, STATES… MUST GET STARTED ON THIS HIGHLY STRATEGIC AND LUCRATIVE MARKET!

Biden Administration Releases Plan for $50 Billion Investment in Chips

U.S. Department of Commerce – 7h • 7 hours ago

“This is a once-in-a-lifetime opportunity, a once-in-a-generation opportunity, to secure our national security and revitalize American manufacturing and revitalize American innovation and research and development,” U.S. Secretary of Commerce Gina Raimondo said. “So, although we’re working with urgency, we have to get it right, and that’s why we are laying out the strategy now.”

The Commerce Department has said its goal is to encourage the production of leading-edge semiconductors and shore up the supply of chips currently in use

CHIPS & Science Act of 2022

President Biden signed into law a historic investment that will help revitalize the U.S. domestic manufacturing economy

The strategy includes key initiatives, timelines for funding notices, recommendations for successful applications

Today, the U.S. Department of Commerce released its strategy outlining how the Department will implement $50 billion from the bipartisan CHIPS Act of 2022, signed by President Biden last month. The CHIPS for America program, housed within the Department’s National Institute of Standards and Technology (NIST), will revitalize the domestic semiconductor industry and spur innovation while creating good-paying jobs in communities across the country.

“Rebuilding America’s leadership in the semiconductor industry is a down payment on our future as a global leader,” said U.S. Secretary of Commerce Gina Raimondo. “CHIPS for America will ensure continued US leadership in the industries that underpin our national security and economic competitiveness. Under President Biden’s leadership, we are once again making things in America, revitalizing our manufacturing industry after decades of disinvestment and making the investments we need to lead the world in technology and innovation.”

The strategy, released today [9/06/2022], outlines the initiatives, strategic goals, and guardrails guiding the CHIPS for America program.

The program’s four primary goals are:

- Establish and expand domestic production of leading-edge semiconductors in the US, of which the US currently makes 0% of the world’s supply

- Build a sufficient and stable supply of mature node semiconductors

- Invest in R&D to ensure the next-generation semiconductor technology is developed and produced in the US.

- Create tens of thousands of good-paying manufacturing jobs and more than a hundred thousand construction jobs. This effort will ensure the pipeline for these jobs expands to include people who have historically not had a chance to participate in this industry, including women, people of color, veterans, and people who live in rural areas.

The program supports three distinct initiatives:

- Large-scale investments in leading-edge manufacturing: The CHIPS incentives program will target approximately three-quarters of the incentives funding, around $28 billion, to establish domestic production of leading-edge logic and memory chips that require the most sophisticated manufacturing processes available today. Those amounts may be available for grants or cooperative agreements, or to subsidize loans or loan guarantees. The Department is still assessing the impact of the newly enacted advanced manufacturing facility investment tax credit on capital expenditures, which will generate significant additional project investment from participants and will reduce the required share of CHIPS incentives funding allocated for leading-edge projects. The Department will seek proposals for the construction or expansion of manufacturing facilities to fabricate, package, assemble, and test these critical components, particularly focusing on projects that involve multiple high-cost production lines and associated supplier ecosystems.

- New manufacturing capacity for mature and current-generation chips, new and specialty technologies, and semiconductor industry suppliers: The CHIPS incentives program will increase domestic production of semiconductors across a range of nodes including chips used in defense and critical commercial sectors such as automobiles, information and communications technology, and medical devices. This initiative is broad and flexible, encouraging industry participants to craft creative proposals. For this initiative, the Department expects dozens of awards with the total value expected to be at least a quarter of the available CHIPS incentives funding, or approximately $10 billion. Those amounts may be available for grants or cooperative agreements, or to subsidize loans or loan guarantees.

- Initiatives to strengthen US leadership in R&D: The CHIPS R&D program will invest $11 billion in a National Semiconductor Technology Center, a National Advanced Packaging Manufacturing Program, up to three new Manufacturing USA Institutes, and in NIST metrology research and development programs. This constellation of programs is intended to create a dynamic new network of innovation for the semiconductor ecosystem in the United States. Executing this vision will require collaboration with academia, industry, and allied countries, and will require sustained investment over many years.

The Strategy also provides clear recommendations for potential applicants, reinforcing the Department’s commitment to advancing long-term strategic goals and identifying criteria against which applications will be evaluated. The criteria include:

- Increase scale and attract private capital: The CHIPS incentives program will encourage large-scale investments that attract associated suppliers and workforce investments. In addition to committing their significant resources, potential applicants are encouraged to explore creative financing structures to tap a variety of sources of capital.

- Leverage collaborations to build out semiconductor ecosystems: The CHIPS incentives program will encourage collaboration between industry stakeholders, investors, customers, designers, suppliers, and international firms. Such collaborations could include purchase commitments, partnerships that enable fabless design, or collaborations between suppliers and producers.

- Secure additional financial incentives and support to build regional and local industry clusters that strengthen communities: The CHIPS incentives program requires applicants to the incentives program to secure state or local incentives. The Department expects to give preference to projects that include state and local incentive packages that maximize regional and local competitiveness, invest in the surrounding community, and prioritize broad economic gains, rather than outsize financial contributions to a single company.

- Establish a secure and resilient semiconductor supply chain: The CHIPS incentives program will prioritize projects that adhere to standards and guidelines on information security, data tracking, and verification, and that collaborate on further development and adoption of such standards.

- Expand the workforce pipeline to match increased domestic capacity workforce needs: The CHIPS incentives program will create good-paying jobs that benefit all Americans, including economically disadvantaged individuals and populations that may be underrepresented in the industry. The program will prioritize workforce solutions that enable employers, training providers, workforce development organizations, labor unions, and other key stakeholders to work together. The goal is to create more paid training and experiential apprenticeship programs, provide wrap-around services, prioritize creative recruitment strategies, and hire workers based on their acquired skills.

- Create inclusive and broadly-shared opportunities for businesses: The CHIPS incentives program will prioritize projects that proactively work to ensure that small businesses, minority-owned, veteran-owned, and women-owned businesses, and businesses in rural areas, benefit from opportunities generated by the CHIPS programs.

- Provide robust financial plans: Applicants will be required to provide detailed project-specific and company-level financial data to ensure that incentive funds are meeting the economic and national security goals of the program while protecting taxpayer dollars.

Funding documents, which will provide specific application guidance for the CHIPS for America program, will be released by early February 2023. Awards and loans will be made on a rolling basis as soon as applications can be responsibly processed, evaluated, and negotiated.

An executive summary of the strategy is available. The full strategy paper can be downloaded here. The Program’s guiding principles can be viewed on the Department’s recently launched CHIPS.gov.